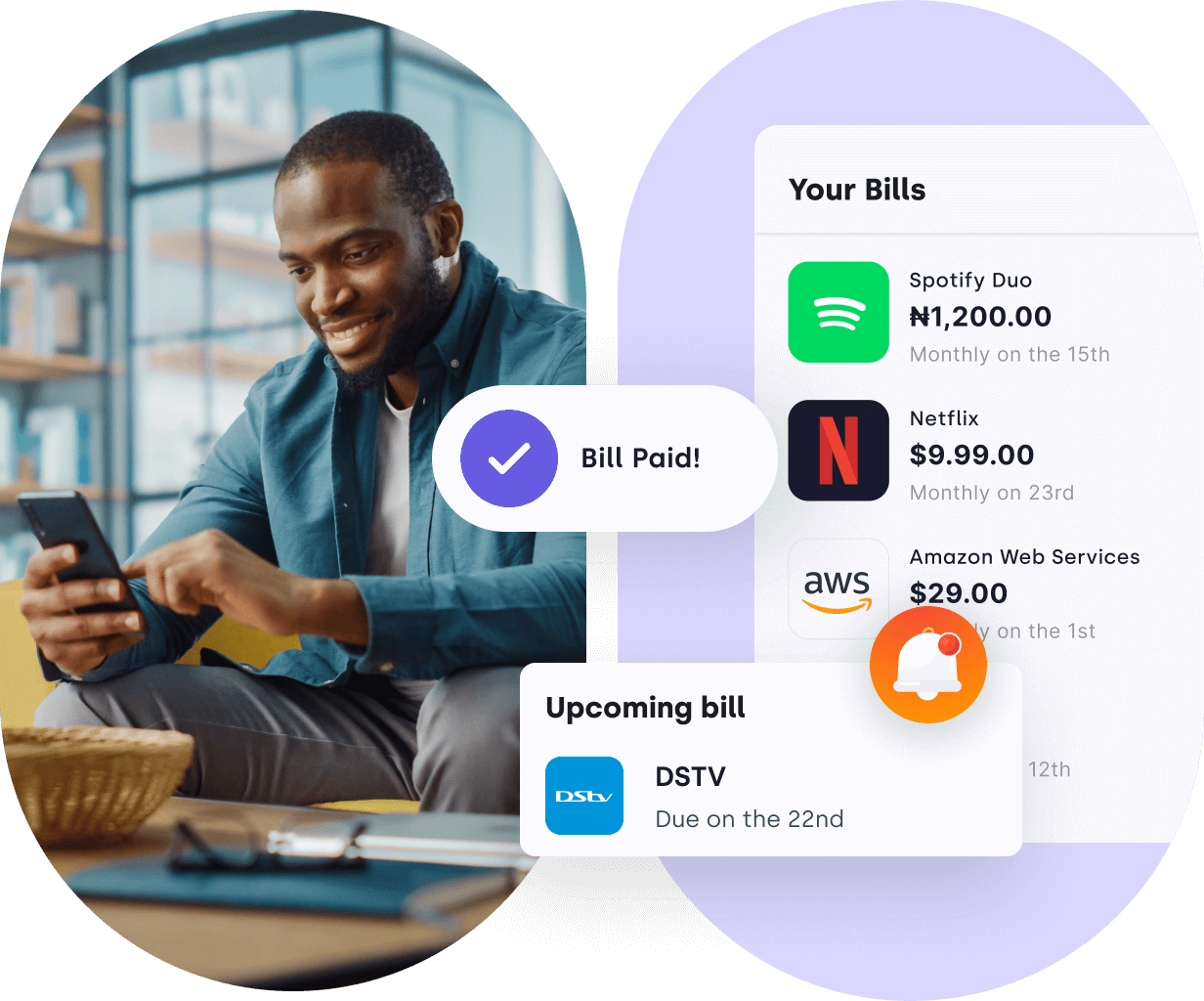

Managing your funds is critical to attaining financial success and stability. Lint, your trusted financial assistant, will guide you through navigating the complexities of budgeting and bill planning. By following these eight steps, you will learn the secrets of money management and pave the road for a brighter financial future.

Step 1: Outline Your Financial Goals

Begin by setting clear and attainable financial objectives. Whether it’s long term goals like planning for retirement, or short-term/mid-term goals like purchasing a new car and saving to pay the rent, setting your goals provides a blueprint for your financial path.

Step 2: Assess Your Income and Expenses

Keep precise records of your income and spending to gain insight into your financial patterns. Doing this will let you know your financial strengths and drawbacks. This way you can prioritise what needs to be included into your bill plan and how much you can allocate for each item.

Step 3: Make a budget

After assessing, create a comprehensive list of all the items that require payments based on your financial goals and lifestyle. Allocate funds for basic needs, savings, and discretionary spending, ensuring that every naira has a purpose.

Step 4: Sign in to Lint and select “Create a Bill Plan”

Click the get started button and then select a currency for your bill plan. After this, name your bill plan. The name could be anything but we recommend you use a name that represents what that bill plan is being created for. For “My Home” could be a name for a bill plan that will contains items such as: light bill, DSTv bill, gateman salary, etc.

Step 5: Add a bill to your plan

Use the “Add bills” button to populate your plan with the transfer, bill, subscription, or financial commitment you need taken care of. Bills are in three categories:

- “Mobile & Utility”

- “Online subscriptions”

- “Bank transfers & Salaries”

If your bill is an online subscription, then a virtual utility card will be generated. You can use the details of your virtual card on merchant sites instead of your bank card. It’s secure and gives you more control over when and how you get billed.

Select the category that best suits your budget item and select what you’re looking for. Alternatively, you can use the search bar to specifically search for what you want.

[IMAGE OF SCREEN PAGE WITH “ADD BILL” CIRCLED

IMAGE OF SCREEN PAGE WITH “CATEGORIES]

Step 6: Setup bill info

After selecting your bill item, it’s time to set up the information. This is generally where you allocate the amount, and set the frequency of the payment (daily, weekly, monthly or yearly) if it is a recurring payment.

[IMAGE OF SCREEN WHERE INFO FOR A BILL IS FILLED]

Step 7: Repeat steps 5 & 6

If your bill plan will contain more than one budget item, repeat steps 4 & 5 to add as many budget items as you need.

Step 8: Fund your bill plan

Your bill plan is ready with all the budget items and it’s time to fund your bill plan. Lint automatically calculates the sum total of what you need to save to cover your bill plan for the month. You either choose to fund the bill plan immediately or fund later.

[IMAGE OF SCREEN WHERE BILL PLAN IS DISPLAYED AND “SAVE MONEY” BUTTON IS CIRCLED]

To fund your plan, Lint will require you do a quick and seamless BVN verification in compliance with CBN regulations. You will only need to do this once on Lint. Lint makes use of high security standards so be rest assured that all your sensitive information remains safe and secure.

YOU’RE DONE!

That’s it! You are finally done with budgeting and creating a bill plan on Lint. You can monitor payments on Lint and track your financial history. Lint also offers you the option to reschedule, pause or remove bill items at your convenience.

It’s time for you to sit back and let Lint do the rest.